Hello,

I am new to blogging but have been very active in political debates and discussion for most of my life. This is one of the longest things I've written, and I have been reluctant to post it anywhere (especially a blog). However, I have finally decided that I am going to start posting my essays in a public forum. I love conservatism and I love writing, I guess it was only a matter of time until I started this.

If you have any thoughts, critiques or just feel and urge to tear me to pieces, be my guest.

Sincerely,

A Young Conservative

An Apology on Behalf of Young America

By A Young Conservative

On November 4th 2008, Senator Barrack Hussein Obama was elected president of the United States of America; the “Land of the Free”.

How did such an unknown, inexperienced young senator from Illinois become the most powerful man in the world? The answer is simple: Blind faith and a zealous following of the ignorant people of America. Just like in any other democratic election, the majority ruled. This wide range of people consists of many different people groups, but most importantly: Young America.

With such a bold accusation, a number of people are probably going to get angry, and disagree. That’s all right! That is their right as Americans.

Obama has transcended the role of a politician running for the White House. He has embodied himself as the essence of “change”, exchanging his arms for “hope” and his legs for “new beginnings”. Because of this, Obama has catered to the most numerous of the class system in America: the lower and middle classes. Socialism, or even social policy, has been proven not to work! But these voters don’t know this, or just don’t care about it; all they know is that their “change” is coming. Of course, using an argument like that can also spark questions: “What about Warren Buffet!” or, “what about all of the rich people in this country? Why would they support him as well?” These questions are valid, and cannot be addressed in a simple blanket answer; but there are a number of more obvious answers.

Guilt: In the way the free market works, there are two groups of people who become rich and successful. The first is a group of people who make money easily, and without hard work. This can include people that are born into wealth, or “make it big” through becoming famous, either through music or athletics. Then there are people who work hard throughout their lives, making an honest living; sacrificing things dear to them, and making wise financial decisions. Which group would be more willing to part with their money, do you think? I would say the first one. The group of people who start making money like its nothing, and don’t know how hard the other group works for theirs. These people somehow rise to the top, not always by their own merits, but rather by either mere coincidence, or moral depravity. These people would be most willing to give to the less fortunate. Because, let’s face it; a couple thousand dollars extra a month won’t seem like anything to them, not compared to the populist appeal they will get, and how good they will look to the general public! Who doesn’t love a philanthropist? Especially one who doesn’t only give away his money, but also his neighbor’s money! More pie please!

Unfortunately, this type of monetary redistribution is exactly what will kill us. It is called socialism, and is creeping into our country like an economic coup. The pieces are being set, and it’s only a matter of time until the last defense we have is broken: the executive branch of our country. Although guilt may not sound like a strong argument at first, the idea can grow on you once you think of all of Obama’s main supporters.

Lack of understanding (In economics, particularly): Most people do not fully understand the Free Market system (Or else Dr. Paul or someone of the sorts would be the current president-elect). Because of this, they love to soak in all the stupid, made up facts and opinions, or twisted, misconstrued information that are thrown at them from various angles (usually from other people like them, or the news) and repeat them. They do this without forming cohesive opinions, and without fully understanding the consequences of their ignorance. They “drink the kool-aid”.

Obama preaches “liberal economics” (aka socialism). In this type of system, money will be taken from those who Obama deems “rich”, and gives to those who Obama deems “not rich”. Well, that doesn’t seem too bad, does it? The reality is that those same people who get taxed more are the very ones who make jobs for the poorer ones. Do you see a problem? This has been tried in various countries, and has either failed miserably, or degraded the work ethic of those who participate (just look at other socialized countries; most explicably, France).

People like Obama will use obvious contrasts, like our current economic situation, to prove that our current form of capitalism doesn’t work, thereby warranting a new change (Obama’s favorite word). People who believe this don’t understand what true capitalism is. “Greedy people in banks” did not create our current economic situation, and neither did “fat cats on wall street”. No, the people who truly created our recession are the same people who are making the accusations! In order to appease a majority (or just the liberals who pretend they represent the majority, it’s hard to tell which), the federal government decided to slash interest rates, preaching “all people should be able to own a home”. Because of this, loans (which would normally not be granted) starting flowing through the country. “No credit, no problem!” is now a commonly heard phrase, made to catch our attention, and sympathize with us. “Oh, I can’t afford a car… but its okay! I’ll just take it on credit!” This new, “I should be able to get whatever I want” kind of mindset exhibits the true “fat cats”… us.

So why blame the banks? Well, why not! That’s the type of thing we normally do, blame each other for something we don’t fully understand; it’s actually childish, isn’t it? Banks, who knew we probably wouldn’t be able to pay the loans back, started to package our mortgages; and they had every right to. Unfortunately, because of the recent flux of housing costs (also a federally constructed problem) and continual inter-bank reselling of these packages, we will see little to no return of their original costs. It is not the banks’ fault (although their extensive inter-bank re-sales didn’t help), it is our fault. We are the ones who selfishly decided to buy things we couldn’t afford; we are the true greedy ones. So how is the government reacting?

Here comes daddy! Big government to the rescue! After the “bailout” bill passed through congress, people started giving mixed reviews. Is this a good thing? Could this help undue the precious acts of stupidity? Or is it just another step towards socialism? Congress decided to give a “get out of bankruptcy free” card to all major banks. The feds decided to spend $750b of OUR money to help keep these banks above water, rewarding their failure with a second chance. That is not how capitalism works! We are in essence loaning to a group of people who couldn’t even loan correctly themselves. So who can blame the banks? With an all rewards, but no risk policy like this one, who wouldn’t do the same?

What most people forget is that this government was not put in place to babysit us our entire lives. The truth is some people just aren’t supposed to own a home! That is what renting is for! The same goes with cars, and anything unnecessary for our existence; how many new, or nearly new cars do you see driving on the roads every day? Why does someone really need a new vehicle? Is it because the older one went out of style? We consistently use our credit to buy things we normally cannot afford. The least we can do is try to be knowledgeable! The ways, and places we invest our money is extremely important, if not life-altering.

As Americans, we are so used to getting what we want, that it has corrupted our interpretation of the role of the federal government. The government was put into place to protect people, by upholding the individual rights of the person, not the “greater good”! We have butchered our interpretation of the term “general welfare”. That doesn’t include redistribution of money! That populist, socialist way of thinking has been opposed all throughout American History!

When Davey Crockett was a congressman, he came across a very charitable bill, a bill that most believed would pass easily. The bill was created in order help pay for the widow of deceased naval officer.7 Surprisingly, instead of helping pass the bill, Crockett gave a very lengthy speech, arguing the constitutional authority of Congress to give away its money for anything other than “public debt”. Crockett further elaborated on the nature of the bill, claiming “If it is a debt, we owe more than we can ever hope to pay, for we owe the widow of every soldier who fought in the war of 1812 precisely the same amount.”

We have the right, as individuals, to give away as much of our own money as we please in charity; but as members of Congress we have no right so to appropriate a dollar of the public money

- Davey Crockett (TNN – Anti-Jacksonian)

Davey Crockett is a man who many would forget served in our government. Although his act of stopping the bill may look like an easy way of saving some money (at the expense of an old lady, and one of respectable character, since she was the wife of a naval officer), it was the principle of the bill he stopped. Crockett understood that the government has no right to do what it wants with the public treasury, even in acts of apparently justified charity.

So is the form of government we have doing this? Isn’t this one of the principles Congressman Davey Crockett tried to stop? We have lowered the bar on our principles; if a congressman was asked to do this with his own money; do you think he would have been as quick to answer?

A Misconstrued Reality

Obama ran his platform on the needs of the middle class. But what exactly is the middle class? Senator Obama has said that the middle class is made up of people who make less than $250,000 annually. These people are the ones who usually provide the backbone of large companies, or work with small businesses. So if Obama plans socialist policies, believes that he will increase the standards of living for the middle class, and is also about to take an office whose sole purpose is to “serve the American people”, isn’t that a contradiction? Catering to a single group of Americans by taking from another group is, according to Obama, the “right thing to do”. But that isn’t serving all Americans!

The “For the greater good” argument is usually a response to a statement such as the one I have just mentioned. I would agree if socialist reforms worked, but they don’t! In the 1950’s, when taxes were some of the lowest in the world, (federal income tax for was 2% of the family budget1), median income American families enjoyed the highest standards of living in the world! Later, in the 1990’s (after social security and other social policies started to come full swing), taxes jumped to 50% for the same kind of family1; forcing the breadwinner to work twenty five times more for the same kind of money. How is climbing the tax going to help? Obama claims that by taking enough money from the upper class, he can redistribute it in such a way that will be better for the general populace.

The “upper class” Obama talks about consists of bankers, doctors, lawyers, business owners, corporate CEOs, CFOs, bond traders… the list goes on! Because these people make so much money, they are seen as a different part of America to Senator Obama, a special “milk-able” sector of the U.S. who can legally be stolen from. Although this may seem unfortunate for the upper class, at least it’s making life better for the majority of the United States, right?

Currently, the top 20% of Americans pay for 80% of its taxes, with somewhere near 40% barely paying anything.8 Is that fair? Some would think so. If this gets higher, why should any of this “cultural elite” stay in this country? Especially with new, booming economies in places like Ireland and South Korea? If these wealthy, business-owing individuals move, why would they want to employ expensive, union-participating Americans, especially when they can get fairer wages in other countries? They won’t.

True Capitalism takes hold of one of the most prominent characteristics of humankind: competition. In a national or even global market, competition is the key factor to keep prices low, products well made, loyal service, and research quick and efficient. In this type of non-intervened market, anything the consumer wants will be brought to him.

The natural price, or the price of free competition ... is the lowest which can be taken, not upon every occasion indeed, but for any considerable time together...[It] is the lowest which the sellers can commonly afford to take, and at the same time continue their business.

- The Wealth of Nations, Book I, Chapter VII

By manipulating the market, the government sets a domino-style system info effect, sending a ripple through the very fabrics of our free-market economy. Companies and businesses need to find ways to deal with new costs. When this happens, they have four choices:

A. Absorb the new costs, not passing it on, and taking a fall of profit.

B. Pass the new costs onto the consumer, raising price of profit.

C. Downsize

D. Move to somewhere cheaper; somewhere the news taxes do not apply.

How are any of those choices good? All affect the consumer, in one way or another. Why would anyone, nonetheless an educated senator, want to continue bringing us further and further from the greatest years in our nation’s history? We should be lowering taxes on businesses, in order to encourage growth! Not taxing them just because they’re there… Not as an easy way to get money! These businesses define America! It shouldn’t be the other way around.

How to Rake in the Dough, Reagan Style

"Only by reducing the growth of government can we increase the growth of the economy."

- Ronald Reagan

President Reagan was in strong opposition of government regulation in the free market. His economic policies had four main objectives:

Reduce the growth of government spending

2) Reduce the marginal tax rates on income

3) Reduce regulation

4) Reduce inflation by controlling the growth of the money supply

In a free market, investors are never guaranteed happy returns. When someone decides to risk their own money, it is because they feel the rewards outweigh those risks. If you shrink the the rewards of investing, the risks look that much bigger. 6

If you tax companies, they will pass that monetary loss onto the consumer (Just as I have previously discussed). How is that helpful at all? Obama plans to destroy the $102k social security cap, raise taxes on those who make more than $250k, and is now trying to raise a new "Global aid" program that will cost more than $1 trillion annually. (Yes, that’s right. Not only does “the greater good” include mandatory charity to other Americans, but now also includes foreign, developing nations. How much of that will actually go to the people, or ever be returned to us, you think?) How is Obama going to pay for all of this? Once again, it comes back to taxing the rich; the same people that work, and run, those companies.

“At some point, additional taxes so discourage the activity being taxed, such as working or investing, that they yield less revenue rather than more. There are, after all, two rates that yield the same amount of revenue: high tax rates on low production, or low rates on high production.”

- Jack Kemp (R-NY)

So how did Reagan deal with this? Why was his “Reaganomic” system so successful? First, let’s look at the facts. Under Reagan’s administration, economic growth averaged 3.2 percent during the Reagan years versus 2.8 percent during the Ford-Carter years and 2.1 percent during the Bush-Clinton years. Real median family income grew by 4,000 during the Reagan period after experiencing no growth in the pre-Reagan years; it experienced a loss of almost $1,500 in the post-Reagan years.2

Reagan dropped the top-tiered personal income tax rate from 70% to 28%. “The economic effects of this Reagan tax cuts were dramatic. When Reagan took office in 1981, the economy was being choked by high inflation and was in the middle of a double-dip recession (1980 and 1982). The tax cuts helped pull the economy out of the doldrums and ushered in the longest period of peacetime economic growth in America's history. During the seven-year Reagan boom, economic growth averaged almost 4 percent.”3

What time has taught is relatively simple. Government taxation has a direct affect on corporate revenue. Simplistically speaking, the lower the taxes, the more revenue will be gained as a percentage of GDP. So, “lower taxes, more money”.

"Raising taxes encourages taxpayers to shift, hide and underreport income. . . . Higher taxes reduce the incentives to work, produce, invest and save, thereby dampening overall economic activity and job creation."

- Kurt Hauser

Not surprisingly, this almost perfect philosophy of taxation is not a new thing…

“High taxes, sometimes by diminishing the consumption of the taxed commodities, and sometimes by encouraging smuggling, frequently afford a smaller revenue to government than what might be drawn from more moderate taxes.”

- Adam Smith

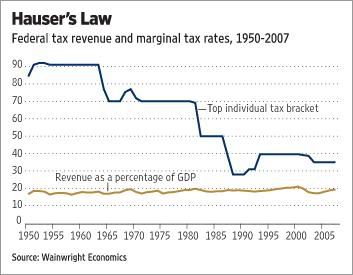

David Ranson, of the Wall Street Journal, elaborates on this graph, explaining in his own words the acclaimed tax method devised as “Hauser’s Law”:

“Will increasing tax rates on the rich increase revenues..? Mr. Hauser uncovered the means to answer these questions definitively. On this page in 1993, he stated that “No matter what the tax rates have been, in postwar America tax revenues have remained at about 19.5% of GDP.” …

The chart nearby, updating the evidence to 2007, confirms Hauser’s Law. The federal tax “yield” (revenues divided by GDP) has remained close to 19.5%, even as the top tax bracket was brought down from 91% to the present 35%.

The data shows that the tax yield has been independent of marginal tax rates over this period, but tax revenue is directly proportional to GDP. So if we want to increase tax revenue, we need to increase GDP.

What happens if we instead raise tax rates? Economists all over the place accept that a tax rate hike will reduce GDP, in which case Hauser’s Law says it will also lower tax revenue. That’s a highly inconvenient truth for redistributive tax policy, and it flies in the face of deeply felt beliefs about social justice. It would surely be unpopular today with those presidential candidates who plan to raise tax rates on the rich – if they knew about it…”5

So what does all of this mean? Well, it proves that Reagan’s tax cuts were successful, (despite what many critics may bring up about the national deficit. By the end of the Reagan years, the economy had grown almost one third larger than it was when Reagan took office. Reagan’s democratic congress spent that money as fast as they got it.) Between 1978 and 1981 capital gains taxes were cut from 35% percent to 20% percent. But is that even a good thing? Does it “encourage growth”? Well, revenues soared by 90 percent in real terms between 1978 and 1985. So, once Congress lifted the rate to 28% in 1986, capital gains revenues declined by 20 percent by 1990. I would say the numbers speak for themselves.4

Does this make Obama’s plan worse automatically, just because it’s different than Reagan’s? Why no, it doesn’t. It just makes it a new, progressive “change” from the type of system that worked best for America. It is a theoretical system that slaps capitalism in the face, and is lifted up so high with such desperate hope, that the entire logical part of the scheme behind it doesn’t even matter anymore, nonetheless discussed in very public forums.

Obama’s policy is an anti-American form of economics, one that has been tried repeatedly and failed. Why would he try to bring it back again? Well, because he’s Barack Obama of course! Why would anything not work when he’s behind it? He’s our savior, for goodness sake! Anything he does is automatically American; even the founding fathers support it! (I am being sarcastic, of course).

“To take from one, because it is thought his own industry and that of his fathers has acquired too much, in order to spare to others, who, or whose fathers, have not exercised equal industry and skill, is to violate arbitrarily the first principle of association, the guarantee to everyone the free exercise of his industry and the fruits acquired by it.”

“A wise and frugal government… shall restrain men from injuring one another, shall leave them otherwise free to regulate their own pursuits of industry and improvement, and shall not take from the mouth of labor the bread it has earned. This is the sum of good government.”

- Thomas Jefferson

“I am for doing good to the poor, but I differ in opinion of the means. I think the best way of doing good to the poor, is not making them easy in poverty, but leading or driving them out of it.”

- Benjamin Franklin

“I cannot undertake to lay my finger on that article of the Constitution which granted a right to Congress of expending, on objects of benevolence, the money of their constituents.”

- James Madison

One can either take their advice or not; it’s not like they were intelligent people anyway, right?

Unfortunately, Obama’s most popular following doesn’t respect the founding fathers opinions. They blindly follow their leader like a pop star, singing his praises in order to win their friend’s approval, or just to be “different”. Most of the time, this following only knows as much as they are told, and follow it madly. They are Obama’s most loyal following, and his best volunteers. The “Hitler Youth” of Obama’s campaign: Young America.

Where Our Vindication Lies

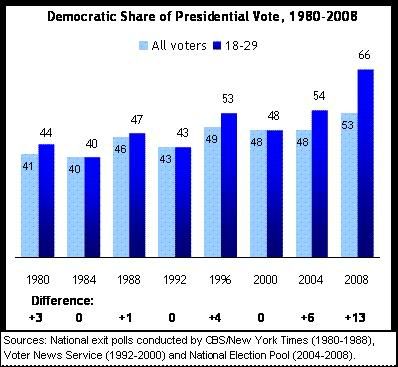

This 2008 election marked the largest participation of young voters in history, in both the Democratic and Republic parties. My generation has grown up with television as one of our main hobbies, taking up a majority of our time. Of course, with most in Hollywood being liberal, some of the far left secular garbage has filtered through. With popular rap artists, actresses and actors, musicians and general famous people supporting “change”, it wasn’t hard to foresee an Obama victory. I have countless friends, all swearing by Obama’s name, trying to replace their lack of an intelligent, political opinion by swapping it with an ignorant, populist one. Sometimes it feels like the only reason they support Obama is so that they can identify their small minded emotions with a new change; that somehow having a new, more “hip” president will bring meaning to their rather shallow existences.

It feels like they are supporting Obama only to say “yeah, I voted for Obama, I ‘Barocked’ the vote!” They act like they know something no one else does, like they’re “in the know”. That is probably the most frustrating part of it for me. When I know the truth, but the people I talk to think they know the truth, and act upon that hypothetical knowledge.

So how many people have been inspired by such faith from the younger generations of America? I would be up all night if I was to list all of Obama’s supporters who could potentially make money on his popularized campaign.

I point out the obvious, stereotypical zeal and tenacity that Obama’s supporters display for one reason: it’s true. Now that my generation has chosen something, they will stick to it for as long as they can. I imagine my fellow “Mellenialists” feel powerful now, with their newly discovered power of persuasion.

Although we were far from crucial to the election, we, the young voters, played a definite part. If not in the form of an actual physical, direct vote, definitely by “drowning out” the wiser, more intellectually based people that did.

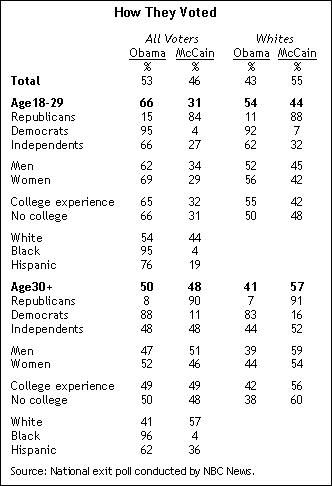

As you can see, most young people identify as democrats, I wonder why that is? Personally, I feel that we are entering a cultural shift. Many of my friends, neighbors; everyone my age has started to become more liberal. A new “the government should do this for me” mindset is taking over. Increase laziness is a usual sign of this, and I believe that is easily confirmed with the social programs on the Democratic agenda.

Although I try to find the sources everyday, only the symptoms are prevalent. Is it the colleges, universities, the places where students go to learn the “truth”? Or are we to blame ourselves for this problem… a self-created delusion; a paradigm shift in the way we react to the world. Could this possibly be my generation’s hostile, confused response to the “world culture”? Every day, powerful people in powerful positions are making us more acceptable to other nations; whether it is tolerance of new (and sometimes bizarre) religions, or socializing our medical and economic systems just because “everyone else is doing it”... Do we understand the consequences?

Strangely enough however, every time I talk to an Obama-leaning friend of mine, and once they actually fully understand what it is I am saying, they usually change their mind. So I guess I can’t doubt the actual mental capacity of those who vote for this man, only their comprehension and reasoning skills. The only thing that keeps these zealot’s holds onto such a well-spoken man is their ignorance.

But what can I, as a sixteen-year-old sophomore in high school, do to help prevent this shift? There is almost nothing… My generation, in mass, has already decided what will happen:

We have decided to reject the free market system that has proved itself over and over again. We have decided to reject saving innocent people in Iraq. We have decided to reject the Judeo-Christian values that have guided our country. We have decided to reject the idea that an unborn child is an actual person. We have decided to reject the idea that everyone should work hard for their money. And worst of all, we have rejected conservatism in and of itself, and along with it, the Republican Party.

So I would like to apologize to the Newt Gingrichs, Ron Pauls, James Madisons, Ronald Reagans, Thomas Jeffersons and Alexander Hamiltons of our country. I feel as though it is my fault, like I didn’t do enough. But what is there for me to do? I have done all I can to undo the spread of ignorance; to cure the plague that has been channeled through the youth in our nation. I wonder how many adult, voting-age people have changed their minds because of the consistent, confident words of “reason” regurgitated by their younger counterparts. I wonder how many people have been drawn to vote for Obama by their friends, and follow through with it because they think that their voices are heard in defiance; thinking they are “challenging the status quo”. I wonder how many people have been touched because of the vast number of young people volunteering for Obama’s campaign team… It blows my mind.

So please forgive me, and my friends for not doing enough. Please forgive us, the Young Conservatives, for not being outspoken and clever enough to spread the seeds of conservatism to all who would, or wouldn’t listen. We are the ones who are supposed to take your places, and I feel like we have failed you. I would hate to think what our nation will look like in twenty, thirty years from now, when we no longer have the intelligent, well spoken conservative leaders we have presently. The way some of my friends mock conservative policies, letting them glance off their thoughts without a second taken to consider their value… It makes me sad to see how far we have fallen.

I feel the only way we can redeem ourselves is if a stronger, more passionate generation of leaders comes out from this trauma, and if he is one of ours, one of my generation. If that day comes, I will once again feel debtless; free from a heavy burden of guilt I now carry on my conscious.

But in the meantime, please forgive us, the Young Americans. Please forgive us for allowing a new advent of liberalism to take place. Forgive us for letting the very lifeblood of conservatism slip through our fingers.

Sources: (1) http://www.lp.org/issues/family-budget (2) http://www.cato.org/pub_display.php?pub_id=1120 (3) http://www.heritage.org/Research/Taxes/BG1086.cfm (4) http://www.econlib.org/library/Enc1/Reaganomics.html (5) http://online.wsj.com/article/SB121124460502305693.html?mod=rss_Today%27s_Most_Popular (6) http://www.econlib.org/library/Enc1/Reaganomics.html (7) http://www.theadvocates.org/library/christian-crockett.html (8) http://www.rushlimbaugh.com/home/menu/top_50__of_wage_earners_pay_96_09__of_income_taxes.guest.html

No comments:

Post a Comment